| Madrid | Spain (Photo: W.Tsai) |

However, if you’re anything like me and enjoy planning your own vacation and deciding when and where to go in your own time, then this article is for you. Last spring I planned a 16 day trip around Spain from my laptop. All you really need is 3 Apps (Skyscanner, Booking.com & Dropbox), Google Map and a credit card.

Keep in mind, if you're not planning to visit abroad, all these Apps are still as useful for domestic getaways. Studies have shown that holidays and breaks are necessary for the well-being of the working class, and one should take these times off even if you don't believe you need it.

Keep in mind, if you're not planning to visit abroad, all these Apps are still as useful for domestic getaways. Studies have shown that holidays and breaks are necessary for the well-being of the working class, and one should take these times off even if you don't believe you need it.

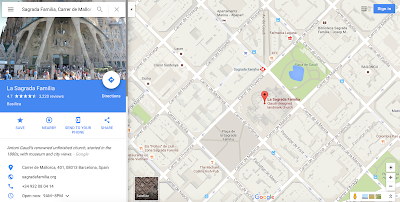

STEP 1

Decide where in the world you would like to go. Open Google Map and view nearby places or use street views for specific area’s. Street view comes particularly handy when looking for accommodation, as you should have a look at your surrounds before committing to the reservation. You can also calculate distance with Google Maps, so you can see how far to travel between cities or even just from the Metro Stations to your apartment.

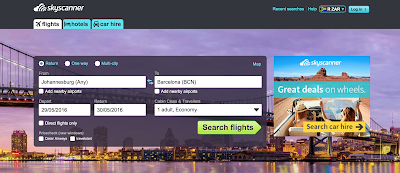

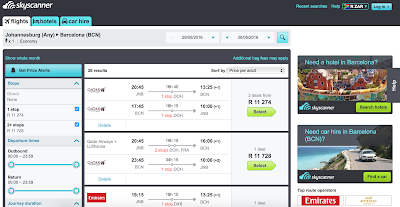

STEP 2

After you've decided on your destination, go to Skyscanner or download the App. Enter your destination and dates and Skyscanner would search all possible flights and arrange them by price. You can also filter by airline. If you don’t know where you’d like to go, you can also select ‘Everywhere’ as your destination and Skyscanner would search for the cheapest flights to various destination. There is also car rental and hotel options on the site.

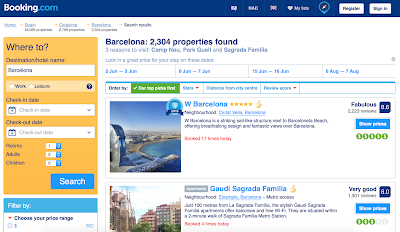

STEP 3

Once you’ve decided on your dates, go to Booking.com or download the App. Enter your destination and dates and select the price range, accommodation type, etc. Booking.com would then search and feed you with a list of options. The more detailed you complete the filters, the smaller the list would become. It is advisable to read reviews from other guests so that you don’t get fooled by the marketing material the owners have loaded.

STEP 4

When you’ve made your decisions, reserve, reserve, reserve, this is where the credit card comes into play. Most online purchases or bookings require one to use a credit card, so if you don't have one, this might be a bit more challenging. Keep in mind, many banks offer free travel insurance with plane tickets purchased on your credit card, which is a score.

STEP 5

All your reservations, plane tickets, accommodation, etc. would send you a mail. Open a dropbox account and upload all your confirmations, and additional documents for safe keeping in case you loose your hard copy. I usually scan my passport and upload that as well, just in case I loose it. Most companies work on a digital system nowadays so it's not even necessary to print out your confirmations.

Make sure you have checked the visa requirements for your destination, and if all is in place then you are ready to go. Happy travelling!