In our previous article (I need R16 Million to survive retirement) we spoke about how you should go about doing the calculations to see how much you need to have saved to survive your retirement when the time comes. The result was grim for most of us, and since we don't want this blog to only be the bearer of bad news, we are going to tell you how saving R25 000.00 over 5 years (R5 000.00/year) will give you over R1 Million upon retirement.

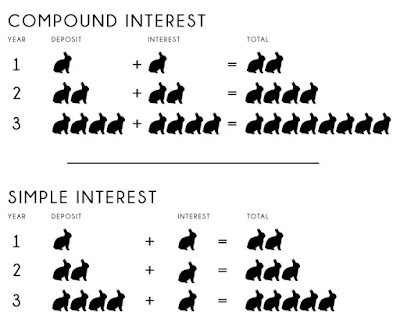

The secret is a little thing called compound interest. Compound interest is interest that builds onto your initial deposit plus the previous interest earned. In short it is interest on interest. Compound interest will allow your savings to grow faster than that of simple interest.

For example, your interest rate is 1 bunny for 1 bunny. With compound interest on 1 bunny, you will get 1 bunny interest, and you add it to your current bunny making it 2 bunnies, and there after you will get interest on that. Where as with simple interest, you get interest on the amount of bunnies from your initial (principal) deposit. In this case, your interest would be 1 bunny every time.

Now moving away from bunnies and to money value. Below, I have illustrated that if you save R5 000.00 each year from age 24 to 28 (5 years), and thereafter nothing until 65 when you will retire. With a 10% annual compound, you will have R1 141 786.00 in your savings account. We have in the previous article clarified that, that would not be enough, however you can image what your savings could be if you were to continue saving at the same rate. Keeping in mind, the earlier you begin saving, the better.

If you are interested in knowing what you need to save and what you would like your outcome to be. Provide me with your age and monthly deposit amount, and we will assist you in doing the calculation. Mail us at: mailtheworking@gmail.com

Compound intrest is all good and well, but it sure ain't as straight forward. There are too many factors influencing intrest rates and the most important factor is inflation (others include the monetary policy of the central bank, GDP of a country and even expected uncertainty).

ReplyDeleteIt is most important to rember that a Rand today is worth more than that same Rand is worth tomorrow. And saving 1Mil by retirement will not allow the purchase power as it does today.

Having said that, I personally don't think that saving (on either simple or compound intrest) is a very efficient way of saving for the future. It's a save-ish bet yes, but certainly not the best - especially in a country in an economic state as SA is at the moment.

Thanks for the informed comment above $$MissMoneyBangs$$.

DeleteSaving on compound interest is definitely not the most efficient way to save for the future, however as you mentioned it is a safe solution and has little risk, especially for younger (early 20's) people who have little experience with complex finance plans.

Would you care to weigh in on what you would recommend for South African's?